In this post we give an introduction to the Heston model which is one of the most used stochastic volatility model. It assumes that the

In this post, we will see how to price a risky bond with a reduced-form model for default risk.

We assume in this first two parts that there is no recovery rate in case of default.

First, we consider a risk-free zero-coupon bond.

The buyer of the bond will receive the face value of the bond (100) at the maturity of the bond and he will pay at t = 0 a price (PriceZCRF) equal to the face value time the discount factor. There is no payment of coupons here.

The discout factor is equal to exp(-r.T) with continuous compounding.

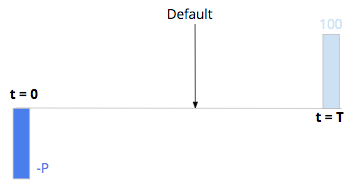

Now we consider a risky zero coupon bond. We assume zero recovery rate. There is the payment of principal at maturity T if there is no default before, the price of the bond is P. In case of default before the maturity of the bond, the bondholder will not recover any part of his initial investment.

We model the default risk with a constant default intensity model (link). The probability that there is no default before T P(τ≥T), the survival probability, is:

λ is the default intensity of the issuer of the bond, τ the times of default.

If there is a default before T, the bondholder will not recover any part of the principal of the bond. The probability that there is a default before T is 1- exp(-λ.T).

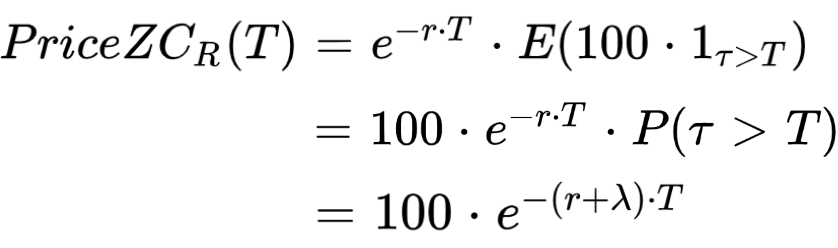

With no arbitrage assumption the price of the bond at t = 0 (PriceZCR) is the discounted expectation of the final payoff:

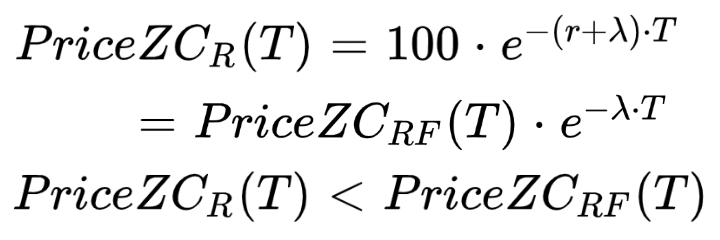

The price of the risky zero coupon bond is equal to the price of the risk free zero coupon bond times the survival probability.

The zero coupon bond has a lower price compared to the risk free bond. If an investor buy the bond, keep it until its expiry and the issuer does not default, he could expect a higher return, a positive carry to compensate for the default risk of the bond.

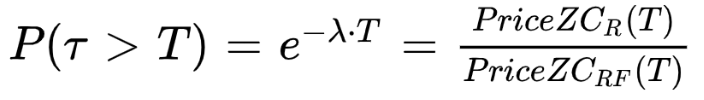

The survival probability can be estimated as the ratio between the prices of the risk free and the risky zero coupon bond.

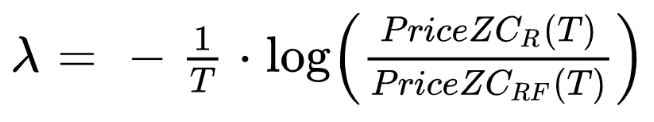

And we get an estimation of the default intensity from market prices.

The z-spread is the spread that needs to be added to the risk-free rate to obtain the price of the risky bond. It is the additional compensation asked by investors for taking that risk.

With Z the z-spread of the risky zero coupon bond we have:

With continous compounding we get:

r + z is the bond yield.

We see that in this framework the z-spread is equal to the default intensity of the bond.

This is only true if we assume zero recovery rate.

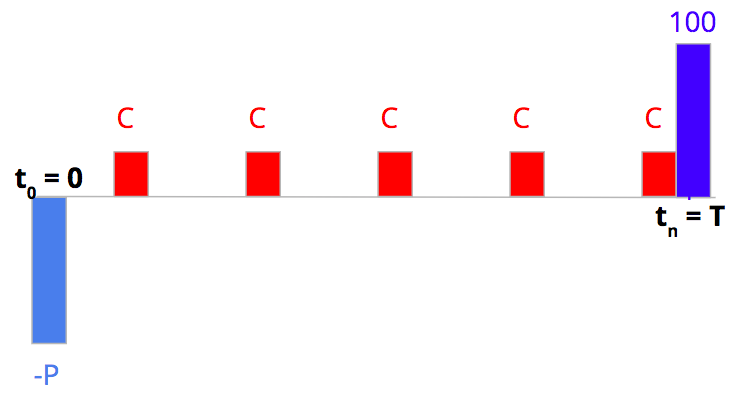

First, we consider a risk-free bond paying a coupon C, with principal 100 and maturity T.

with Rti the risk free rate, its price PRF is, by non arbitrage:

Assuming continuous compounding and constant interest rate r the price of the risk-free bond is:

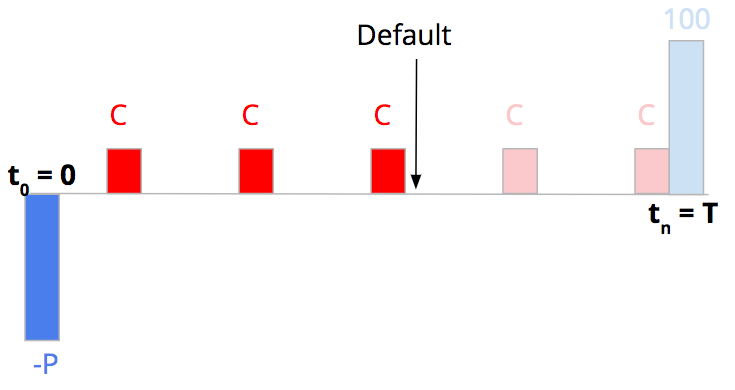

Now we consider a risky bond paying coupons. Coupons are paid as long as there is no default. We assume zero recovery rate. In case of default, the bondholder will not recover any part of his initial investment.

The sum of the discounted cash-flow is:

with continuous compounding:

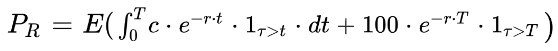

The price of the risky bond is the expectation of the sum of the discounted cash-flows:

The expectation of the indicator function at t is the survival probability, the probability that there is no default before t:

With a constant default intensity model we obtain:

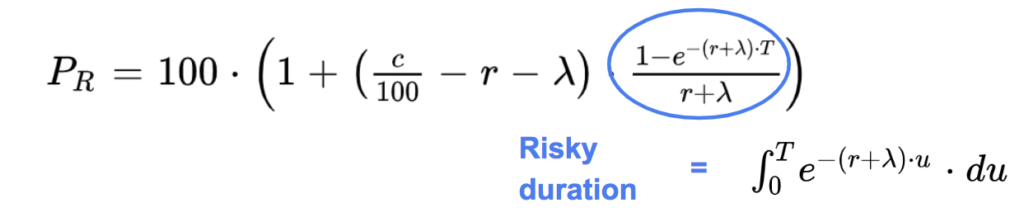

And if we calculate the integral term we obtain this expression:

It can be rewritten like this:

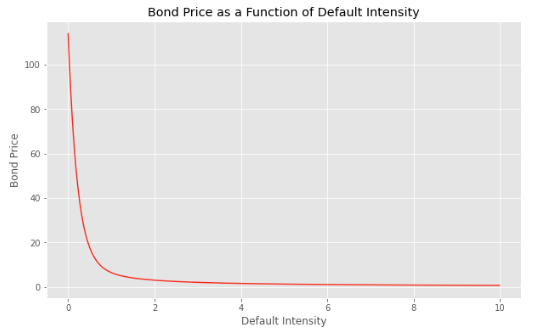

We see that the price of the risky bond is higher than 100 if the coupon of the bond divided by 100 is strictly higher than the sum of the risk free interest rate r and the default intensity lambda.

If will be below 100 if it is strictly below.

And the bond will be at par if the two are equal.

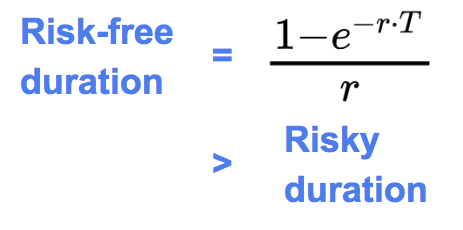

The last term is the risky duration. It is the integral of the discount factor times the survival probability between 0 and T.

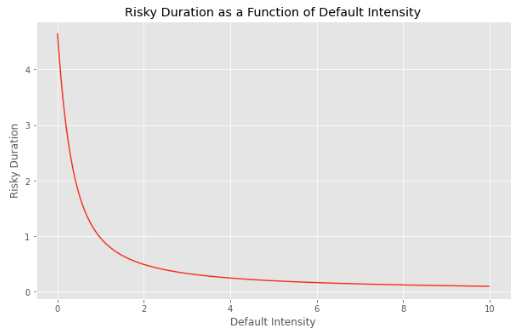

The risky duration is lower than the non risky duration as it includes as well the risk of default before the expiry of the bond. The higher the default risk of the issuer, the lower the risky duration.

When lambda tends to infinity, meaning that the default probability tends to 1, the risky duration tends to zero, and the bond price as well.

Below is the Python code with the calculation of the riskyduration and the bond price assuming zero recovery rate in case of default.

Python Code

import matplotlib.pyplot as plt

plt.style.use('ggplot')

import numpy as nplambda_ = np.arange(0,10,0.01)

r = 0.03 #risk-free interest rate

T = 5 #time to maturity of the bond in years

riskyduration = (1 - np.exp(-(r + lambda_) * T)) / (r + lambda_)

plt.figure(figsize=(10, 6))

plt.plot(lambda_, riskyduration)

plt.title('Risky Duration as a Function of Default Intensity')

plt.xlabel('Default Intensity')

plt.ylabel('Risky Duration')

plt.show()

c = 6 #coupon

price = 100 * (1 + (c / 100 - r - lambda_) * riskyduration)

plt.figure(figsize=(10, 6))

plt.plot(lambda_, price)

plt.title('Bond Price as a Function of Default Intensity')

plt.xlabel('Default Intensity')

plt.ylabel('Bond Price')

plt.show()

As a reminder, the z-spread Z is the spread that needs to be added to the risk-free rate to obtain the price of the risky bond. It is the additional compensation asked by investors for taking that risk.

With continuous compounding, we obtain this relationship between the bond price and the z-spread z.

And if we compare it with the expression of the bond price as a function of the default intensity lambda assuming that there is no recovery rate in case of default, we see that the z-spread z is equal to the default intensity lambda.

We will see that this is no more true if the recovery rate is not null in the next part.

This is only true if we assume zero recovery rate.

Credit Risk Modelling: the Probability of Default

Credit Risk Modelling: the Default Time Distribution

An Introduction to Reduced-Form Credit Risk Models

Pricing of a Defaultable Bond with a Reduced-Form Model (Part III, IV, V)

Save 25% on All Quant Next Courses with the Coupon Code: QuantNextBlog25

For students and graduates: We offer a 50% discount on all courses, please contact us if you are interested: contact@quant-next.com

We summarize below quantitative finance training courses proposed by Quant Next. Courses are 100% digital, they are composed of many videos, quizzes, applications and tutorials in Python.

Complete training program:

Options, Pricing, and Risk Management Part I: introduction to derivatives, arbitrage free pricing, Black-Scholes model, option Greeks and risk management.

Options, Pricing, and Risk Management Part II: numerical methods for option pricing (Monte Carlo simulations, finite difference methods), replication and risk management of exotic options.

Options, Pricing, and Risk Management Part III: modelling of the volatility surface, parametric models with a focus on the SVI model, and stochastic volatility models with a focus on the Heston and the SABR models.

A la carte:

Monte Carlo Simulations for Option Pricing: introduction to Monte Carlo simulations, applications to price options, methods to accelerate computation speed (quasi-Monte Carlo, variance reduction, code optimisation).

Finite Difference Methods for Option Pricing: numerical solving of the Black-Scholes equation, focus on the three main methods: explicit, implicit and Crank-Nicolson.

Replication and Risk Management of Exotic Options: dynamic and static replication methods of exotic options with several concrete examples.

Volatility Surface Parameterization: the SVI Model: introduction on the modelling of the volatility surface implied by option prices, focus on the parametric methods, and particularly on the Stochastic Volatility Inspired (SVI) model and some of its extensions.

The SABR Model: deep dive on on the SABR (Stochastic Alpha Beta Rho) model, one popular stochastic volatility model developed to model the dynamic of the forward price and to price options.

The Heston Model for Option Pricing: deep dive on the Heston model, one of the most popular stochastic volatility model for the pricing of options.

In this post we give an introduction to the Heston model which is one of the most used stochastic volatility model. It assumes that the

In the previous post (link) dedicated to the pricing of defaultable bonds with a reduced form model, we saw how to price a zero coupon

The Merton Jump Diffusion (MJD) model was introduced in a previous article (link). It is an extension of the Black-Scholes model adding a jump part