The Heston Model: an Introduction

In this post we give an introduction to the Heston model which is one of the most used stochastic volatility model. It assumes that the

You will find here articles, guides, tutorials related to quantitative finance.

In this post we give an introduction to the Heston model which is one of the most used stochastic volatility model. It assumes that the

In the previous post (link) dedicated to the pricing of defaultable bonds with a reduced form model, we saw how to price a zero coupon

The Merton Jump Diffusion (MJD) model was introduced in a previous article (link). It is an extension of the Black-Scholes model adding a jump part

The final payoff of a binary (or digital) call option is either one if the asset price is above the strike price at the expiry

In this post, we will see how to price a risky bond with a reduced-form model for default risk. We assume in this first two

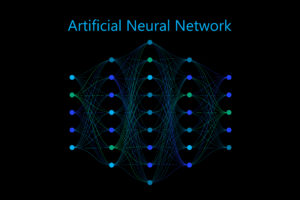

We will introduce in this post stochastic volatility models. They assume that the asset price but also its variance follow stochastic processes. Such models are

There are two main families of default models. Structural models, such as the Merton model based on the firm’s assets and liabilities and reduced-form models

Monte Carlo is a very flexible numerical method which can model and price complex instruments when other methods can not. But it has the strong

The buyer of an American Option has the right to exercise the option at any time before and including the maturity date of the option

We will focus here on the default time distribution. We will see the relationship between the cumulative and the marginal default rates and how these

Finite-difference methods is the generic term for a large number of techniques that can be used for solving differential equations, approximating derivatives with finite differences.

We will focus here on the probability of default, one of the key measure of credit risk, introducing different ways to measure it. What is

The Fourier Transform The spectral decomposition of a period function via Fourier series can be generalised to any integrale function via the Fourier transform. And

We will give an introduction to credit risk, presenting the main types of credit risk, the key components and measures of credit risk, discussing the

P&L Attribution & Greeks: Vanna and Volga Risks Greeks are used to understand and manage the different dimensions of risk involved when trading options. With

In the Heston model, both the dynamic of the asset price and its instantaneous variance nu are stochastic. The model assumes that the variance follows

The Black-Scholes Model The Black-Scholes model is a pricing model used to determine the theoretical price of options contracts. It was developed by Fischer Black

The Black-Scholes model was developed by Fischer Black and Myron Scholes in 1973 and later refined by Robert Merton. It was the first arbitrage free

The Principal Component Analysis or PCA is a statistical technique for reducing the dimension of a large dataset. It does it by transforming the dataset

It is crucial for quant or trading positions to have a strong understanding of the main option Greeks and how they can be used for

Merton Jump Diffusion Model The Merton Jump Diffusion model proposed by Merton in 1976 is an extension of the Black-Scholes model (link). It contains: μ:

The Poisson process N(t) is a counting process used to describe the occurrence of events in a time interval of length t. It satisfies the

The Cox-Ingersoll-Ross (CIR) model is a stochastic interest rate model used in finance to describe the evolution of interest rates. The model was introduced in

We present here two methods for calibrating the Vasicek model (link) to historical data: The Python code is available below. Presentation Save 25% on All

The Vasicek model is a mathematical model used in finance to describe the movement of interest rates over time. It was developed by Oldrich Vasicek

The Brownian motion is one of the most famous and important stochastic process. Let’s start with a bit of history. Robert Brown discovered the Brownian

The option price C(S0, K, T) is homogeneous in order 1 in (S0, K) when: C(λ.S0, λ.K, T) = λ.C(S0, K, T) This is true

You will find in this document the results of a series of questions posted on LinkedIn to test your knowledge on Options, Pricing and Risk

In previous articles (see Options, Greeks and P&L Decomposition (Part 1) and Options, Greeks and P&L Decomposition (Part 2)) we decomposed the P&L of simple

In this article, we will present the Newton-Raphson method for calculating the implied volatility from option prices. Black-Scholes Price vs Volatility In Black-Scholes model, the

The valuation and the risk management of options can be quickly complex. It depends on the option’s feature and the pricing model. There is often

In a previous article (see Options, Greeks and P&L Decomposition (Part 1)) we analysed the decomposition of the P&L of an option strategy in a

The Black-Scholes model is a pricing model used to determine the theoretical price of options contracts. It was developed by Fischer Black and Myron Scholes

Understanding option sensitivities and greeks is crucial to be successful in trading and risk management of options. In this post we will see how to

What is it? How does it work? Principal Component Analysis (PCA) is a statistical method for reducing the dimension of a dataset. It is a

The Volatility is Constant in the Black-Scholes Model… In the Black-Scholes model, the volatility of a stock price is assumed to be constant, independent of

Foundations of Stochastic Calculus Stochastic Calculus is a branch of mathematics that deals with random processes. Beyond probabilities it also has links with differential equations,