In this post we give an introduction to the Heston model which is one of the most used stochastic volatility model. It assumes that the

We will give an introduction to credit risk, presenting the main types of credit risk, the key components and measures of credit risk, discussing the different factors influencing it and ways to manage it.

Credit risk refers to the potential that a borrower or counterparty will fail to meet its obligations in accordance with terms of agreements, leading to a financial loss for the lender.

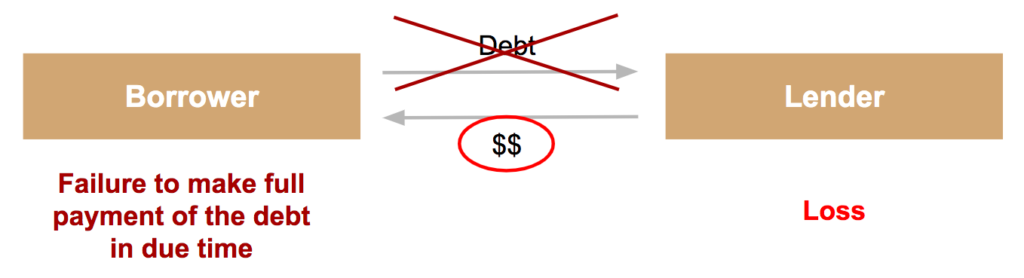

Example 1: credit risk on a debt

We consider a borrower, having some debt to a lender. If the borrower fails to make full payment of the debt in due time there will be a loss for the lender.

The borrower can be an individual, a company such as a corporate or a financial institution or a government, a sovereign or municipal borrower for instance.

The debt can be through a loan with a financial institution acting as the lender or through a bond with investors providing the capital.

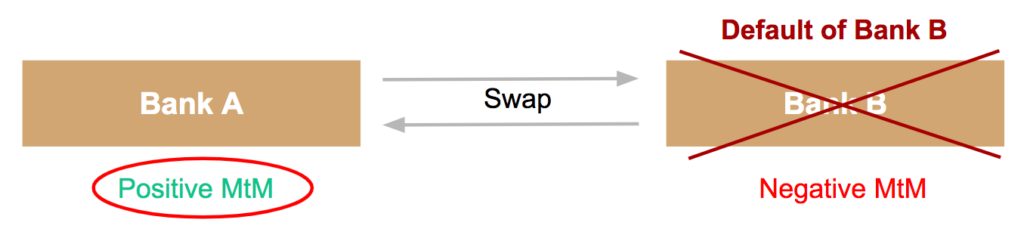

Example 2: counterparty credit risk on a derivatives

Another example is the counterparty credit risk on derivatives. Let’s consider a swap between a bank A and a bank B, we assume that bank A has a positive mark-to-market while bank B has a negative one, if bank B default, then bank A is at risk on its positive mark-to-market, bank B might not be able to pay the total amount due to bank A.

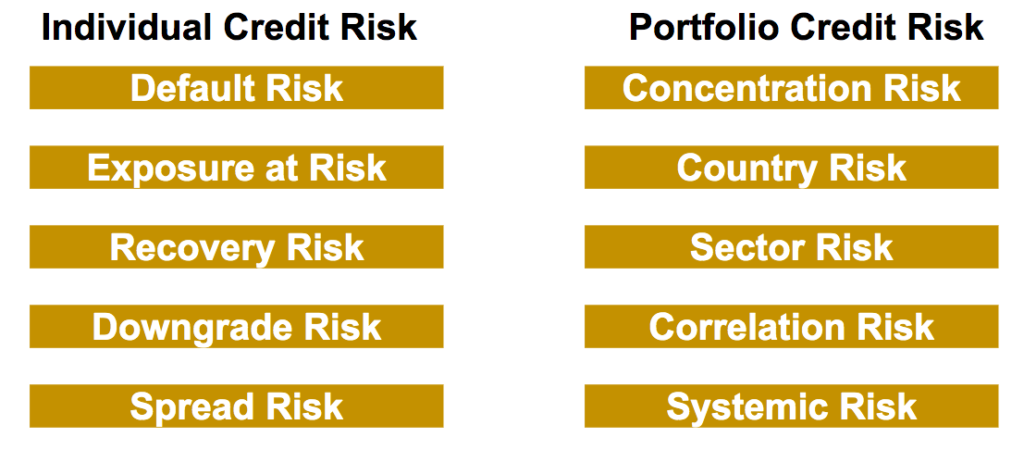

There are different types of credit risks which can be classified in two categories, individual and portfolio credit risk.

Individual Credit Risk

Portfolio Credit Risk

There are several key measures to quantify and manage credit risk.

Probability of Default

The probability of default PD is the likelihood that a borrower will fail to meet their debt obligations within a specified time period.

Exposure at Default

The Exposure at Default (EAD) is the total value a lender is exposed to at the time when a borrower or a counterparty defaults.

It depends on the type of instrument we consider.

For term loans it is simply the outstanding amount.

For off-balance sheet financing such as loan commitments, letters of credit or revolving facilities we can use of a credit conversion factor to estimate the additional amount of debt in the future.

For counterparty credit risk on derivatives, the exposure at default corresponds to the positive mark to market value + potential future exposures.

Loss Given Default

The Loss Given Default (LGD) is the percentage of an exposure that a lender expects to lose if a borrower defaults on a loan or a bond, after accounting for recoveries from collateral or other sources.

Several factors influence its value, including potential collaterals, guarantees, the type of instrument or the seniority of the debt.

Expected Loss and Unexpected Loss

The expected Loss (EL) is the average loss a lender expects to incur from defaults over a specific period, calculated as the product of the probability of default (PD), exposure at default (EAD), and loss given default (LGD).

EL = PD x EAD x LGD

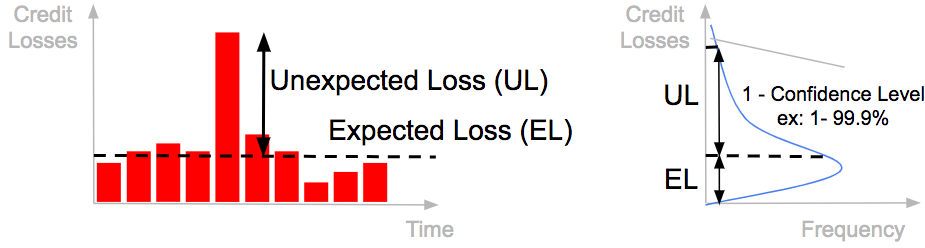

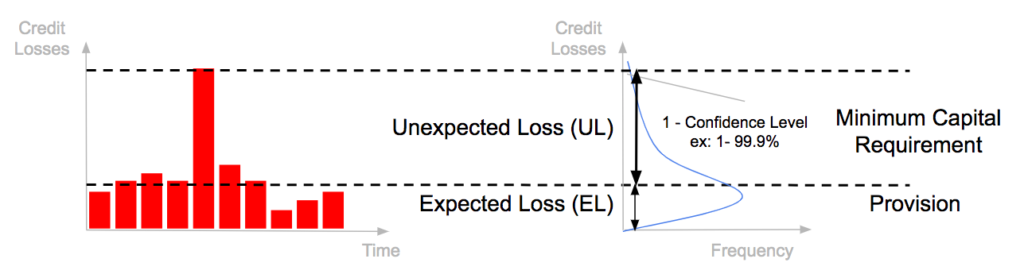

If we consider credit losses of a portfolio over time, the expected loss is the average loss.

But there are risks of concentration, dependences between defaults, and losses can typically derive from the average when there is an economic crisis.

This potential loss that exceeds the expected loss in extreme adverse scenarios is the so-called unexpected loss (UL).

When modelling the credit risk of a portfolio, the expected loss is the average loss of the credit loss distribution. We fix a certain threshold, level of confidence, at 99.9% for example, the unexpected loss is the difference between the corresponding percentile of the distribution and the expected loss.

Credit Rating

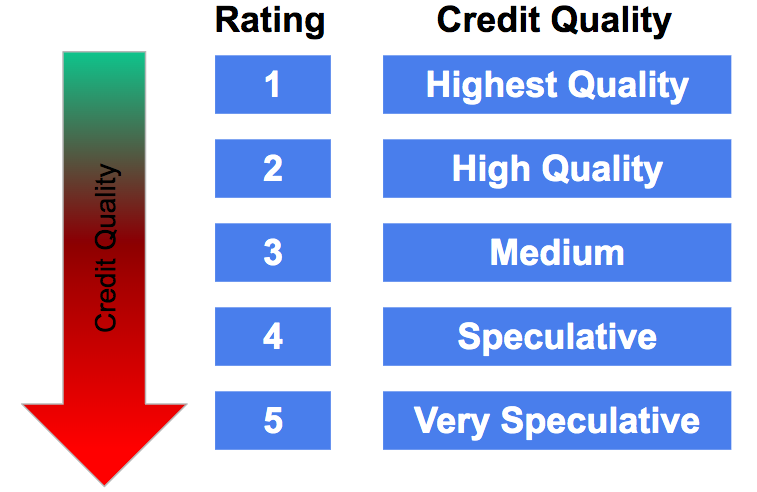

Ratings help to measure the credit quality of a borrower, ranking borrowers from the ones with the highest quality and lowest credit risk to the ones with the lowest quality, very speculative with the highest credit risk.

But rating can change over time. A borrower can default, with a certain default probability but it can also be downgraded meaning a higher default risk of the borrower.

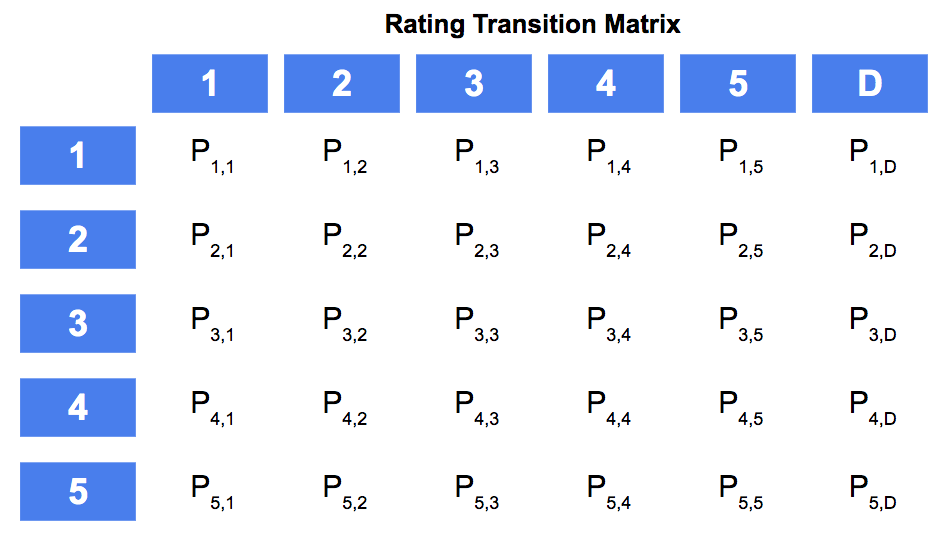

Rating transition matrices help to summarise all these possible movements, with probabilities of upgrade, downgrade or default for the different ratings with a specific period of time.

There are three main rating agencies Moody’s, S&P and Fitch that assess the creditworthiness of entities and securities.

Bond Prices and Spread Risk

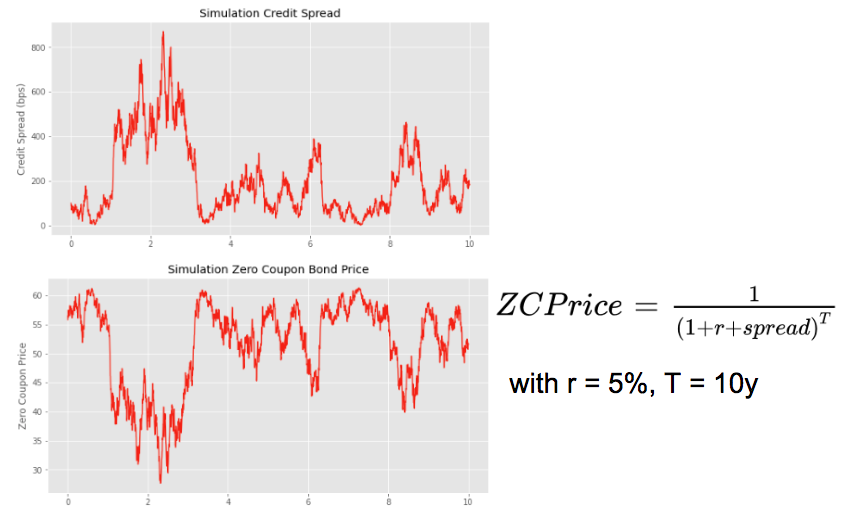

Bond prices decrease when credit spreads widen. It becomes more expensive for issuer to borrow money while bond investors suffer MtM losses.

We simulate here a path of 10y credit spread and the price of a theoretical 10y zero coupon bond, the risk free interest being fixed at 5%.

In order to cover for potential loan losses due to credit risk, the expected loss, financial institutions put some provisions, so that they can absorb losses from defaulted loans.

They are also required to hold a minimum amount of capital, financial resources to protect against unexpected losses. This ensures the institution can absorb losses and continue operations during periods of financial stress, thereby protecting depositors and maintaining overall financial system stability.

Effective credit risk management is key for financial institutions to ensure their stability and profitability. It includes:

Credit Risk Modelling: the Probability of Default

Credit Risk Modelling: the Default Time Distribution

An Introduction to Reduced-Form Credit Risk Models

Pricing of a Defaultable Bond with a Reduced-Form Model (Part I)

Pricing of a Defaultable Bond with a Reduced-Form Model (Part III, IV, V)

Save 25% on All Quant Next Courses with the Coupon Code: QuantNextBlog25

For students and graduates: We offer a 50% discount on all courses, please contact us if you are interested: contact@quant-next.com

We summarize below quantitative finance training courses proposed by Quant Next. Courses are 100% digital, they are composed of many videos, quizzes, applications and tutorials in Python.

Complete training program:

Options, Pricing, and Risk Management Part I: introduction to derivatives, arbitrage free pricing, Black-Scholes model, option Greeks and risk management.

Options, Pricing, and Risk Management Part II: numerical methods for option pricing (Monte Carlo simulations, finite difference methods), replication and risk management of exotic options.

Options, Pricing, and Risk Management Part III: modelling of the volatility surface, parametric models with a focus on the SVI model, and stochastic volatility models with a focus on the Heston and the SABR models.

A la carte:

Monte Carlo Simulations for Option Pricing: introduction to Monte Carlo simulations, applications to price options, methods to accelerate computation speed (quasi-Monte Carlo, variance reduction, code optimisation).

Finite Difference Methods for Option Pricing: numerical solving of the Black-Scholes equation, focus on the three main methods: explicit, implicit and Crank-Nicolson.

Replication and Risk Management of Exotic Options: dynamic and static replication methods of exotic options with several concrete examples.

Volatility Surface Parameterization: the SVI Model: introduction on the modelling of the volatility surface implied by option prices, focus on the parametric methods, and particularly on the Stochastic Volatility Inspired (SVI) model and some of its extensions.

The SABR Model: deep dive on on the SABR (Stochastic Alpha Beta Rho) model, one popular stochastic volatility model developed to model the dynamic of the forward price and to price options.

The Heston Model for Option Pricing: deep dive on the Heston model, one of the most popular stochastic volatility model for the pricing of options.

In this post we give an introduction to the Heston model which is one of the most used stochastic volatility model. It assumes that the

In the previous post (link) dedicated to the pricing of defaultable bonds with a reduced form model, we saw how to price a zero coupon

The Merton Jump Diffusion (MJD) model was introduced in a previous article (link). It is an extension of the Black-Scholes model adding a jump part