In this post we give an introduction to the Heston model which is one of the most used stochastic volatility model. It assumes that the

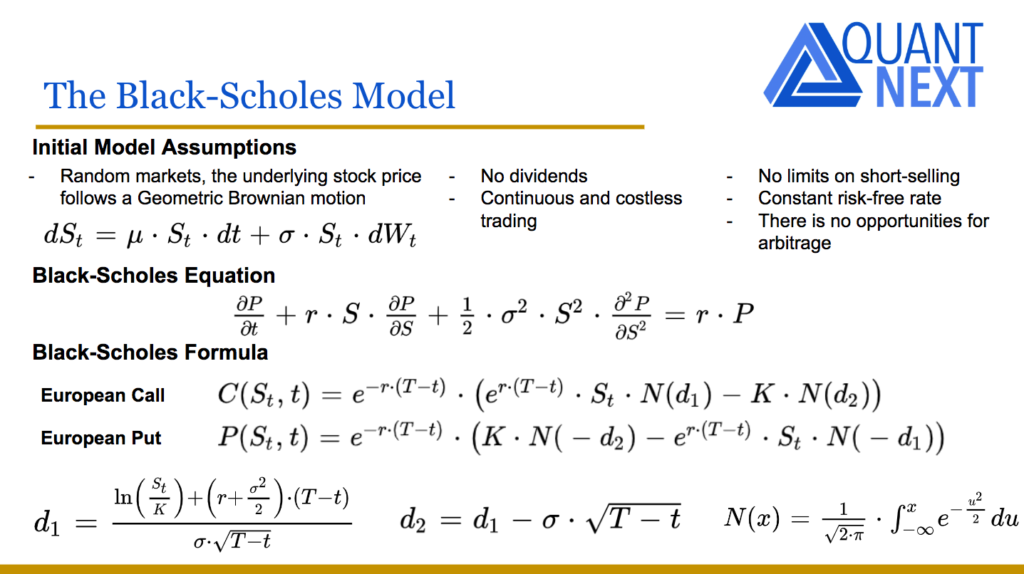

The Black-Scholes model was developed by Fischer Black and Myron Scholes in 1973 and later refined by Robert Merton.

It was the first arbitrage free model relating the option price to the hedging strategy consisting of buying or selling the underlying asset to eliminate the risk.

It is well known that some of the assumptions of the model are not empirically valid, particularly the fact that it assumes a constant volatility of the underlying asset price which it is not true in practice. But it is actually its simplicity and its elegance which may explain the popularity of the model.

The Black-Scholes model uses only one unobservable variable, the asset price volatility, to price European vanilla options.

And the Black-Scholes formula allows to translate option prices into implied volatilities, with a one-to-one relationship. There is one unique volatility implied by the price of an option and vice versa.

It is more convenient for traders to quote options in terms of implied volatilities rather than option prices. It remains more stable when the underlying price, or the time to maturity changes. It is a bit like yields for bonds. And the Black-Scholes implied volatility became quickly the market standard to quote vanilla options.

Similarly to the yield term structure implied by the prices of bonds issued by the same issuer with different time to maturity, with an additional dimension there is a volatility surface implied by option prices on the same underlying asset with different strike prices and expiry dates.

Moreover, the volatility is directly related to the risk of the underlying asset. It corresponds to the second moment, the standard deviation of log return distribution, making the implied volatility a measure which can be directly compared to the realised volatility of the underlying asset price.

Black-Scholes sensitivities, or Greeks, such as Delta, Vega, Rho, Theta, Gamma, Vanna or Volga, all available with closed-form formulas are market standards to measure and manage the risks of an option portfolio.

Even if more advanced models are often required to price and risk manage complex products or to model the volatility surface and its dynamic, the Black-Scholes model remains one of the foundation of modern quantitative finance, and it is key for all quants or aspiring quants to master it.

Save 25% on All Quant Next Courses with the Coupon Code: QuantNextBlog25

For students and graduates: We offer a 50% discount on all courses, please contact us if you are interested: contact@quant-next.com

We summarize below quantitative finance training courses proposed by Quant Next. Courses are 100% digital, they are composed of many videos, quizzes, applications and tutorials in Python.

Complete training program:

Options, Pricing, and Risk Management Part I: introduction to derivatives, arbitrage free pricing, Black-Scholes model, option Greeks and risk management.

Options, Pricing, and Risk Management Part II: numerical methods for option pricing (Monte Carlo simulations, finite difference methods), replication and risk management of exotic options.

Options, Pricing, and Risk Management Part III: modelling of the volatility surface, parametric models with a focus on the SVI model, and stochastic volatility models with a focus on the Heston and the SABR models.

A la carte:

Monte Carlo Simulations for Option Pricing: introduction to Monte Carlo simulations, applications to price options, methods to accelerate computation speed (quasi-Monte Carlo, variance reduction, code optimisation).

Finite Difference Methods for Option Pricing: numerical solving of the Black-Scholes equation, focus on the three main methods: explicit, implicit and Crank-Nicolson.

Replication and Risk Management of Exotic Options: dynamic and static replication methods of exotic options with several concrete examples.

Volatility Surface Parameterization: the SVI Model: introduction on the modelling of the volatility surface implied by option prices, focus on the parametric methods, and particularly on the Stochastic Volatility Inspired (SVI) model and some of its extensions.

The SABR Model: deep dive on on the SABR (Stochastic Alpha Beta Rho) model, one popular stochastic volatility model developed to model the dynamic of the forward price and to price options.

The Heston Model for Option Pricing: deep dive on the Heston model, one of the most popular stochastic volatility model for the pricing of options.

In this post we give an introduction to the Heston model which is one of the most used stochastic volatility model. It assumes that the

In the previous post (link) dedicated to the pricing of defaultable bonds with a reduced form model, we saw how to price a zero coupon

The Merton Jump Diffusion (MJD) model was introduced in a previous article (link). It is an extension of the Black-Scholes model adding a jump part