In this post we give an introduction to the Heston model which is one of the most used stochastic volatility model. It assumes that the

In previous articles (see Options, Greeks and P&L Decomposition (Part 1) and Options, Greeks and P&L Decomposition (Part 2)) we decomposed the P&L of simple option strategies in different time horizons with the major first and second order greeks.

In this article, we analyse the P&L of a short iron butterfly option strategy, which is a combination of a long straddle and a short strangle strategies, on a short period of time.

We show that the P&L of the strategy is mostly explained by the vega and the volga risks. While the vega risk can be managed by adjusting the long / short quantities, the strategy remains exposed to the volga risk which is higher on the wings.

The Python code used in simulations is available at the end of the article.

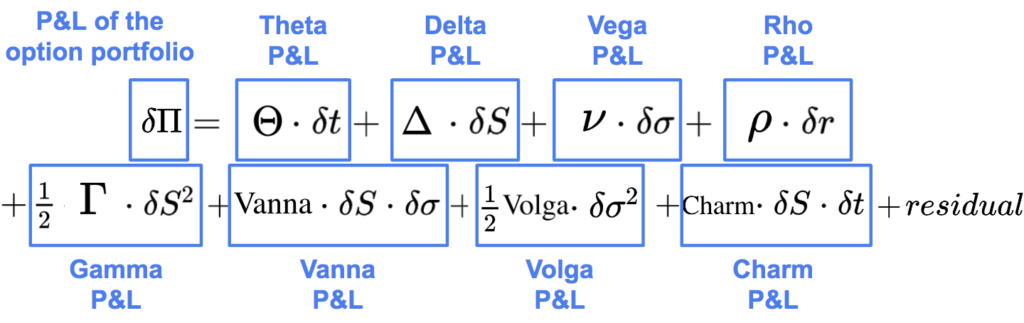

The P&L of an option strategy between t and t+δt can be decomposed with the different first order and second order Greeks:

Theta, delta, vega, rho are the first order Greeks:

On the second line are the most important second order Greeks:

The residual regroups other second order and higher order sensitivities.

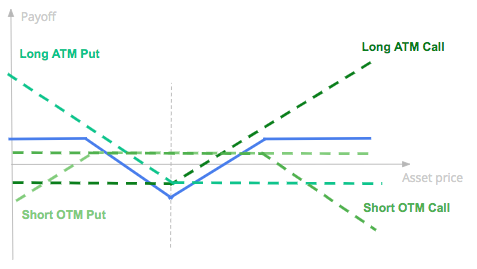

A short iron butterfly strategy consists on:

Such strategy will generate some profits at the maturity of the option if there is an important movement of the underlying asset price both on the downside or on the upside, but the investor is not expecting too high movements as he is selling OTM call and put to finance a part of the purchase of ATM options.

Payoff of a Short Iron Butterfly

In terms of Greeks, a short iron butterfly has:

We will decompose the P&L of a short iron butterfly strategy on a weekly time horizon with different scenarios using these six greeks.

We assume that we are in the Black-Scholes framework, the implied volatility is constant.

Below are the characteristics of the strategy and the market parameters.

#parameters

S0 = 100 #stock price

Kputstraddle = 100 #strike price put long straddle

Kcallstraddle = 100 #strike price call long straddle

Kputstrangle = 95 #strike price put short strangle

Kcallstrangle = 105 #strike price call short strangle

r = .0 #risk-free interest rate

q = .0 #dividend yield

T0 = 21 / 252 #time to maturity

sigma0 = 0.3 #implied volatility BS

dt = 5 / 252 #5bd1/ Stock Price: -5%, Volatility : + 10% in one week

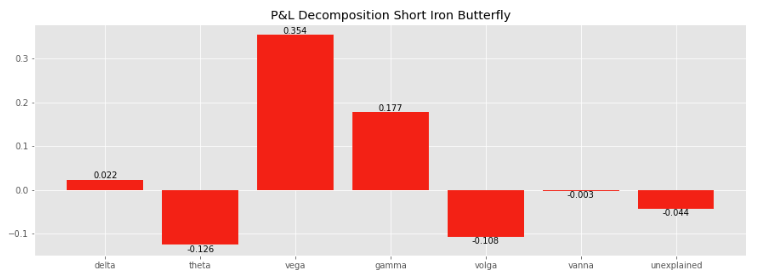

In this first case study, we assume that the stock price goes down by -5% while the implied volatility goes up by +10% in a weekly horizon. We also assume that an equal number of options are bought and sold (1).

dS = -100 * 0.05 #stock movement

dsigma = +0.1 #implied volatility movement

ratio = 1 #if ratio = 1: same number of options are bought and soldAs highlighted in the chart below, the strategy would have performed positively, benefiting mostly from the rise of volatility with its positive vega exposure.

The positive gamma of the short iron butterfly strategy is partly offset by its negative theta, but gamma + theta remains positive in this scenario, the realised volatility being higher than the implied one.

The volga has a negative contribution. As said before, the volga of the strategy, which is selling the wings via the short strangle position, is negative.

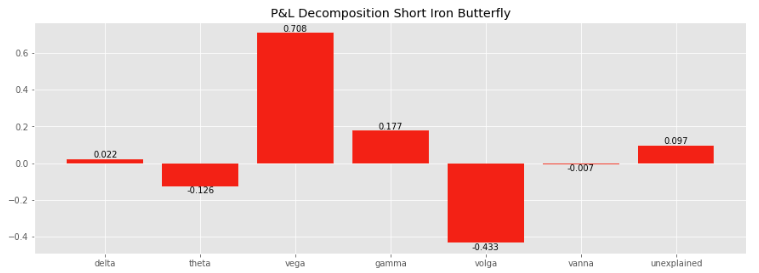

2/ Stock Price: -5%, Volatility + 20% in one week

In this second case study, we assume that the implied volatility increases by +20% from 30% to 50%, while we still assume a decline of -5% of the stock price in a week. We still assume as well that an equal number of options are bought and sold in the butterfly strategy (1).

dS = -100 * 0.05 #stock movement

dsigma = +0.2 #implied volatility movement

ratio = 1 #if ratio = 1: same number of options are bought and soldThe vega P&L is multiplied by two, in line with the higher movement of the implied volatility, while the volga P&L is multiplied by four, explaining a more important part of the P&L of the strategy which remains positive in this second scenario.

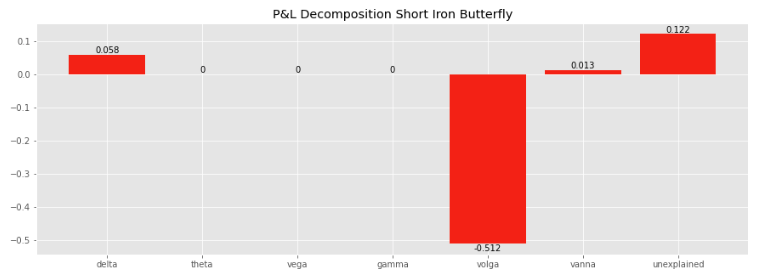

3/ Stock Price: -5%, Volatility + 20% in one week, vega-hedged strategy

In this third case study, we assume that weekly market movements are the same as in the previous: -5% for the stock price, +20% for the implied volatility.

We assume now that the strategy is vega-neutral, we sell more strangle (1.2x) in front of the straddle in order to cancel the vega exposure.

dS = -100 * 0.05 #stock movement

dsigma = +0.2 #implied volatility movement

ratio = (EuropeanOptionBS(S0, Kputstraddle, T0, r, q, sigma0, "Call").vega \

+ EuropeanOptionBS(S0, Kcallstraddle, T0, r, q, sigma0, "Put").vega) \

/ (EuropeanOptionBS(S0, Kputstrangle, T0, r, q, sigma0 + smile, "Call").vega \

+ EuropeanOptionBS(S0, Kcallstrangle, T0, r, q, sigma0 + smile, "Put").vega)

#ratio: number of strangle to be sold in front of the straddle to be vega-neutralBy doing that, we see that the strategy is gamma-neutral in addition to be vega-neutral, the ratio of the vega being the same as the ratio of the gamma.

On the other hand, we are not able to cancel the volga exposure. On the contrary, the negative contribution of the volga is even greater by increasing the number of OTM options we sell. The P&L of the strategy is now negative, mostly explained by its volga.

Save 25% on All Quant Next Courses with the Coupon Code: QuantNextBlog25

For students and graduates: We offer a 50% discount on all courses, please contact us if you are interested: contact@quant-next.com

We summarize below quantitative finance training courses proposed by Quant Next. Courses are 100% digital, they are composed of many videos, quizzes, applications and tutorials in Python.

Complete training program:

Options, Pricing, and Risk Management Part I: introduction to derivatives, arbitrage free pricing, Black-Scholes model, option Greeks and risk management.

Options, Pricing, and Risk Management Part II: numerical methods for option pricing (Monte Carlo simulations, finite difference methods), replication and risk management of exotic options.

Options, Pricing, and Risk Management Part III: modelling of the volatility surface, parametric models with a focus on the SVI model, and stochastic volatility models with a focus on the Heston and the SABR models.

A la carte:

Monte Carlo Simulations for Option Pricing: introduction to Monte Carlo simulations, applications to price options, methods to accelerate computation speed (quasi-Monte Carlo, variance reduction, code optimisation).

Finite Difference Methods for Option Pricing: numerical solving of the Black-Scholes equation, focus on the three main methods: explicit, implicit and Crank-Nicolson.

Replication and Risk Management of Exotic Options: dynamic and static replication methods of exotic options with several concrete examples.

Volatility Surface Parameterization: the SVI Model: introduction on the modelling of the volatility surface implied by option prices, focus on the parametric methods, and particularly on the Stochastic Volatility Inspired (SVI) model and some of its extensions.

The SABR Model: deep dive on on the SABR (Stochastic Alpha Beta Rho) model, one popular stochastic volatility model developed to model the dynamic of the forward price and to price options.

The Heston Model for Option Pricing: deep dive on the Heston model, one of the most popular stochastic volatility model for the pricing of options.

First we import the libraries that will be used and we create a class EuropeanOptionBS with Black-Scholes prices and Greeks with closed-form formulas.

#import libraries

import matplotlib.pyplot as plt

plt.style.use('ggplot')

import math

import numpy as np

import pandas as pd

from scipy.stats import norm

%matplotlib inline

#Black-Scholes price and Greeks

class EuropeanOptionBS:

def __init__(self, S, K, T, r, q, sigma, Type):

self.S = S

self.K = K

self.T = T

self.r = r

self.q = q

self.sigma = sigma

self.Type = Type

self.d1 = self.d1()

self.d2 = self.d2()

self.price = self.price()

self.delta = self.delta()

self.theta = self.theta()

self.vega = self.vega()

self.gamma = self.gamma()

self.volga = self.volga()

self.vanna = self.vanna()

def d1(self):

d1 = (math.log(self.S / self.K) \

+ (self.r - self.q + .5 * (self.sigma ** 2)) * self.T) \

/ (self.sigma * self.T ** .5)

return d1

def d2(self):

d2 = self.d1 - self.sigma * self.T ** .5

return d2

def price(self):

if self.Type == "Call":

price = self.S * math.exp(-self.q * self.T) * norm.cdf(self.d1) \

- self.K * math.exp(-self.r * self.T) * norm.cdf(self.d2)

if self.Type == "Put":

price = self.K * math.exp(-self.r * self.T) * norm.cdf(-self.d2) \

- self.S * math.exp(-self.q * self.T) * norm.cdf(-self.d1)

return price

def delta(self):

if self.Type == "Call":

delta = math.exp(-self.q * self.T) * norm.cdf(self.d1)

if self.Type == "Put":

delta = -math.exp(-self.q * self.T) * norm.cdf(-self.d1)

return delta

def theta(self):

if self.Type == "Call":

theta1 = -math.exp(-self.q * self.T) * \

(self.S * norm.pdf(self.d1) * self.sigma) / (2 * self.T ** .5)

theta2 = self.q * self.S * math.exp(-self.q * self.T) * norm.cdf(self.d1)

theta3 = -self.r * self.K * math.exp(-self.r * self.T) * norm.cdf(self.d2)

theta = theta1 + theta2 + theta3

if self.Type == "Put":

theta1 = -math.exp(-self.q * self.T) * \

(self.S * norm.pdf(self.d1) * self.sigma) / (2 * self.T ** .5)

theta2 = -self.q * self.S * math.exp(-self.q * self.T) * norm.cdf(-self.d1)

theta3 = self.r * self.K * math.exp(-self.r * self.T) * norm.cdf(-self.d2)

theta = theta1 + theta2 + theta3

return theta

def vega(self):

vega = self.S * math.exp(-self.q * self.T) * self.T** .5 * norm.pdf(self.d1)

return vega

def gamma(self):

gamma = math.exp(-self.q * self.T) * norm.pdf(self.d1) / (self.S * self.sigma * self.T** .5)

return gamma

def volga(self):

volga = self.vega / self.sigma * self.d1 * self.d2

return volga

def vanna(self):

vanna = -self.vega / (self.S * self.sigma * self.T** .5) * self.d2

return vannaThen we enter the parameters, we give one example of set of parameters here.

#parameters

S0 = 100 #stock price

Kputstraddle = 100 #strike price put straddle

Kcallstraddle = 100 #strike price call straddle

Kputstrangle = 95 #strike price put strangle

Kcallstrangle = 105 #strike price call strangle

r = .0 #risk-free interest rate

q = .0 #dividend

T0 = 21 / 252 #time to maturity

sigma0 = 0.3 #implied volatility BS

dt = 5 / 252 #5bd

smile = 0.#vol_Kcall - vol_Kput

ratio = (EuropeanOptionBS(S0, Kputstraddle, T0, r, q, sigma0, "Call").vega \

+ EuropeanOptionBS(S0, Kcallstraddle, T0, r, q, sigma0, "Put").vega) \

/ (EuropeanOptionBS(S0, Kputstrangle, T0, r, q, sigma0 + smile, "Call").vega \

+ EuropeanOptionBS(S0, Kcallstrangle, T0, r, q, sigma0 + smile, "Put").vega)

#ratio: number of strangle to be sold in front of the straddle to be vega-neutral

#ratio = 1 #if ratio = 1: same number of options are bought and sold

#Market changes between t and t+dt

dS = -100 * 0.05 #stock movement

dsigma = +0.2 #implied volatility movement

T1 = T0 - dt #time to maturity

S1 = S0 + dS #new stock price

sigma1 = sigma0 + dsigma #new implied volatilityWe calculate the P&L between t and t + δt.

#P&L of the strategy

P0 = EuropeanOptionBS(S0, Kputstraddle, T0, r, q, sigma0, "Call").price \

+ EuropeanOptionBS(S0, Kcallstraddle, T0, r, q, sigma0, "Put").price \

- (EuropeanOptionBS(S0, Kputstrangle, T0, r, q, sigma0 + smile, "Call").price \

+ EuropeanOptionBS(S0, Kcallstrangle, T0, r, q, sigma0 + smile, "Put").price) * ratio

P1 = EuropeanOptionBS(S0, Kputstraddle, T0, r, q, sigma1, "Call").price \

+ EuropeanOptionBS(S0, Kcallstraddle, T0, r, q, sigma1, "Put").price \

- (EuropeanOptionBS(S0, Kputstrangle, T0, r, q, sigma1 + smile, "Call").price \

+ EuropeanOptionBS(S0, Kcallstrangle, T0, r, q, sigma1 + smile, "Put").price) * ratio

delta0 = EuropeanOptionBS(S0, Kputstraddle, T0, r, q, sigma0, "Call").delta \

+ EuropeanOptionBS(S0, Kcallstraddle, T0, r, q, sigma0, "Put").delta \

- (EuropeanOptionBS(S0, Kputstrangle, T0, r, q, sigma0 + smile, "Call").delta \

+ EuropeanOptionBS(S0, Kcallstrangle, T0, r, q, sigma0 + smile, "Put").delta) * ratio

isDeltaHedged = 0 #1 if is delta-hedged, 0 otherwise

dPandL = P1 - P0 - delta0 * dS * isDeltaHedged

print("P&L: " + str(dPandL))We decompose the P&L between the contribution of the different Greeks and we plot it with a barchart.

#initial greeks

delta0 = EuropeanOptionBS(S0, Kputstraddle, T0, r, q, sigma0, "Call").delta \

+ EuropeanOptionBS(S0, Kcallstraddle, T0, r, q, sigma0, "Put").delta \

- (EuropeanOptionBS(S0, Kputstrangle, T0, r, q, sigma0 + smile, "Call").delta \

+ EuropeanOptionBS(S0, Kcallstrangle, T0, r, q, sigma0 + smile, "Put").delta) * ratio

theta0 = EuropeanOptionBS(S0, Kputstraddle, T0, r, q, sigma0, "Call").theta \

+ EuropeanOptionBS(S0, Kcallstraddle, T0, r, q, sigma0, "Put").theta \

- (EuropeanOptionBS(S0, Kputstrangle, T0, r, q, sigma0 + smile, "Call").theta \

+ EuropeanOptionBS(S0, Kcallstrangle, T0, r, q, sigma0 + smile, "Put").theta) * ratio

vega0 = EuropeanOptionBS(S0, Kputstraddle, T0, r, q, sigma0, "Call").vega \

+ EuropeanOptionBS(S0, Kcallstraddle, T0, r, q, sigma0, "Put").vega \

- (EuropeanOptionBS(S0, Kputstrangle, T0, r, q, sigma0 + smile, "Call").vega \

+ EuropeanOptionBS(S0, Kcallstrangle, T0, r, q, sigma0 + smile, "Put").vega) * ratio

gamma0 = EuropeanOptionBS(S0, Kputstraddle, T0, r, q, sigma0, "Call").gamma \

+ EuropeanOptionBS(S0, Kcallstraddle, T0, r, q, sigma0, "Put").gamma \

- (EuropeanOptionBS(S0, Kputstrangle, T0, r, q, sigma0 + smile, "Call").gamma \

+ EuropeanOptionBS(S0, Kcallstrangle, T0, r, q, sigma0 + smile, "Put").gamma) * ratio

volga0 = EuropeanOptionBS(S0, Kputstraddle, T0, r, q, sigma0, "Call").volga \

+ EuropeanOptionBS(S0, Kcallstraddle, T0, r, q, sigma0, "Put").volga \

- (EuropeanOptionBS(S0, Kputstrangle, T0, r, q, sigma0 + smile, "Call").volga \

+ EuropeanOptionBS(S0, Kcallstrangle, T0, r, q, sigma0 + smile, "Put").volga) * ratio

vanna0 = EuropeanOptionBS(S0, Kputstraddle, T0, r, q, sigma0, "Call").vanna \

+ EuropeanOptionBS(S0, Kcallstraddle, T0, r, q, sigma0, "Put").vanna \

- (EuropeanOptionBS(S0, Kputstrangle, T0, r, q, sigma0 + smile, "Call").vanna \

+ EuropeanOptionBS(S0, Kcallstrangle, T0, r, q, sigma0 + smile, "Put").vanna) * ratio

#P&L attribution

delta_PandL = delta0 * dS * (1 - isDeltaHedged)

theta_PandL = theta0 * dt

vega_PandL = vega0 * dsigma

gamma_PandL = 1 / 2 * gamma0 * dS**2

volga_PandL = 1 / 2 * volga0 * dsigma**2

vanna_PandL = vanna0 * dS * dsigma

unexplained = dPandL - sum([delta_PandL, theta_PandL, vega_PandL, gamma_PandL, volga_PandL, vanna_PandL])

y = [delta_PandL, theta_PandL, vega_PandL, gamma_PandL, volga_PandL, vanna_PandL, unexplained]

x = ["delta", "theta", "vega", "gamma", "volga", "vanna","unexplained"]

fig, ax = plt.subplots(figsize = (15,5))

bars = ax.bar(x, np.round(y,3))

plt.title("P&L Decomposition Short Iron Butterfly")

ax.bar_label(bars)

plt.show();

In this post we give an introduction to the Heston model which is one of the most used stochastic volatility model. It assumes that the

In the previous post (link) dedicated to the pricing of defaultable bonds with a reduced form model, we saw how to price a zero coupon

The Merton Jump Diffusion (MJD) model was introduced in a previous article (link). It is an extension of the Black-Scholes model adding a jump part