In this post we give an introduction to the Heston model which is one of the most used stochastic volatility model. It assumes that the

Understanding option sensitivities and greeks is crucial to be successful in trading and risk management of options.

In this post we will see how to decompose the P&L of an option strategy in a short time interval with the major first and second order greeks and analyse it with several case studies.

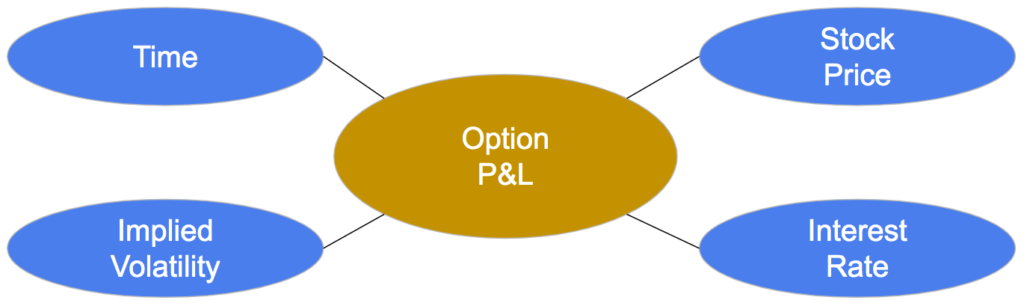

The Black-Scholes price of an option P(t, S, σ, r) is a function of time (t), the stock price (S), the implied volatility (σ) and interest rate (r).

Before the expiration of the option, its price and the P&L of the option position will vary with the dynamic of these four variables and so for risk management purposes it is key to know what is the sensitivity of the option position to changes of these different variables.

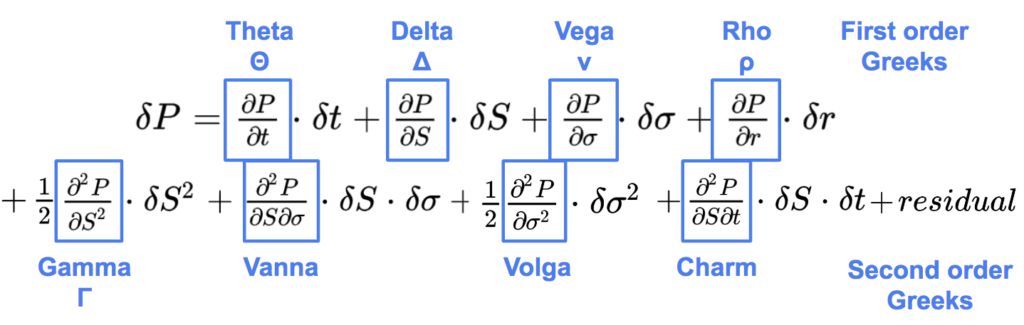

With a second order Taylor expansion of the option value over a short time interval delta t we can decompose the variation of the option price as following.

Theta, delta, vega, rho are the first order Greeks:

On the second line are the most important second order Greeks:

The residual regroups other second order and higher order sensitivities.

We will look now at several case studies, changing market parameters and decomposing the P&L of a long out-of-the-money put option over a short time interval.

We purchase one out-of-the-money put option with a strike price K = 95, and 3 months time to maturity (T = 0.25). The underlying stock price S is equal to 100 initially.

We want to decompose the P&L of the position between t and t + δt with δt equal to one business day (δt = 1 / 252).

We assume that the interest rate and the dividend yield are both equal to zero for sake of simplicity, and we will neglect the charm P&L in the following.

The full Python code used for these analyses is available at the end of the document.

1/ Stock price down, realised volatility = market volatility, constant market volatility

First we assume that we are in Black-Scholes framework, the market implied volatility is constant, and we assume as well that the realised volatility σr is equal to the market one σI .

The realised volatility being:

the square of the change of the stock price is equal to:

We assume that the stock price is going down, so we have:

We use the following parameters:

#parameters

S0 = 100 # stock price

K = 95 # strike price

r = .0 # risk-free interest rate

q = .0 # dividend

T0 = .25 # time to maturity

sigma0 = .4 # implied volatility BS

Type = "Put"

dt = 1 / 252 # 1 business day

# Market changes between t and t + dt

dS = -S0 * sigma0 * dt**.5 # dS^2 / S^2 = sigma0^2 * dt

dsigma = .0

T1 = T0 - dt

S1 = S0 + dS

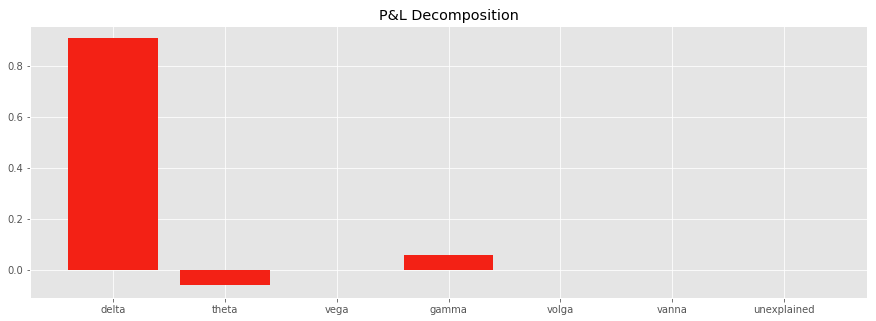

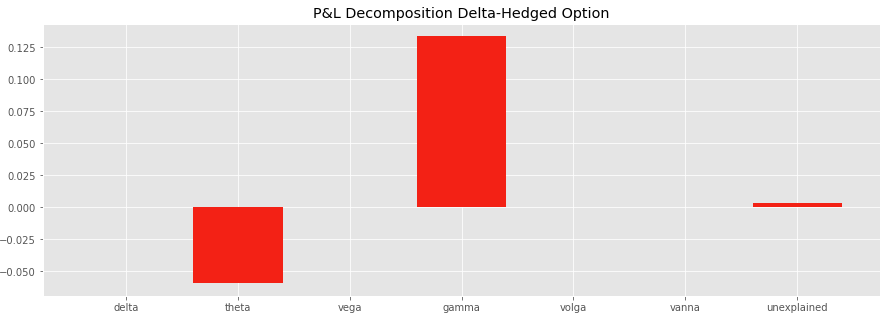

sigma1 = sigma0 + dsigmaWe see on the chart below that the P&L of the option between t and t + δt is mostly explained by its directional exposure, its delta P&L. The delta P&L is positive (0.91 = -2.52 x -0.36) as the stock is going down (-2.52) and the delta of the put option is negative (-0.36).

Theta, the time decay of the option, is the cost of gamma. It is the cost for the convexity of the option measured by the gamma.

As a reminder, we have, with σr the realised volatility:

And if we assume that r = q = 0 we have:

So the P&L of the delta-hedged option between t and t + δt is close to:

In this first example, we assume that the realised volatility is equal to the market volatility so we have:

Theta P&L = – Gamma P&L (= -0.059)

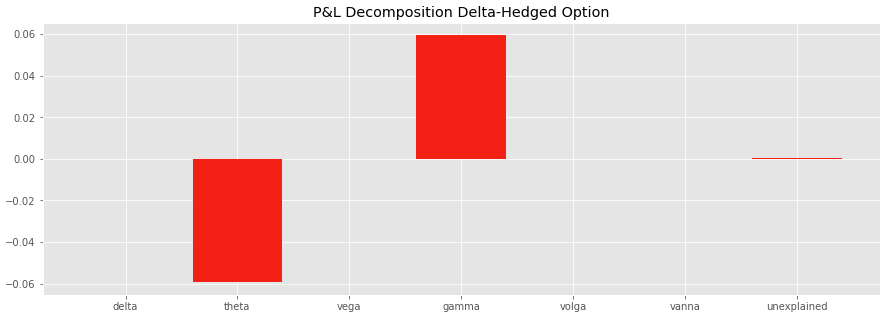

If we delta-hedge the option, by buying 0.36 stocks, the P&L of the delta-hedged option becomes very close to zero between t and t + δt, the positive contribution of the Gamma being fully offset by the negative contribution of the Theta.

2/ Stock price down, realised volatility > market volatility, constant market volatility

We assume now that the realised volatility (60%) is higher than the implied one (40%).

The stock price is still going down, with a more negative movement (-3.78 = -100 * 60% * (1/252)^ .5).

The option is still delta-hedged.

dS = -S0 * .6 * dt**.5 # realised vol = .6The P&L of the long delta-hedged put option is positive (+0.078), Gamma P&L > Theta P&L as the realised volatility is higher than the implied volatility.

In our example, Γ = 0.019, and the P&L portion explained by the gamma and the theta is equal to

1/2 x 0.019 x 100^2 x (0.6^2 – 0.4^2) x 1 / 252 = 0.075

It is close to the P&L of the strategy between t and t + δt.

The unexplained P&L is a bit higher compared to the first case study. This is explained by a more important stock movement and a higher error of the second order Taylor expansion. Higher order sensitivities such as the “speed”, the third order partial derivative of the option with respect to the underlying asset price, are less negligible in this case.

3/ Stock price down, realised volatility > market volatility, market volatility up

In this third case study, we assume as well that the market implied volatility is going up, +10%, all other assumptions being the same as in the previous case study.

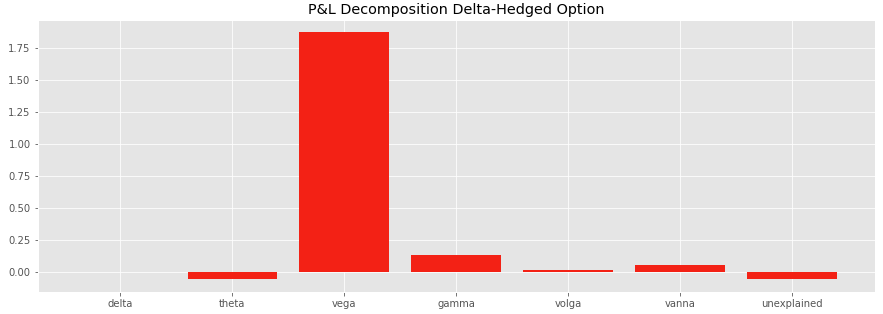

dsigma = .1As highlighted below, the change of volatility has an important impact on the P&L of the delta-hedged put option, most of it being captured by the Vega P&L.

Compared to the previous case study, the P&L of the strategy is higher (+1.95), as the long put option has a positive vega exposure, it gains when the volatility is going up.

Most of the P&L is explained by the Vega P&L (+1.87). The Vanna P&L (0.055), and to a lesser extent the Volga P&L (0.013) are positive as well.

4/ Shorter time to maturity

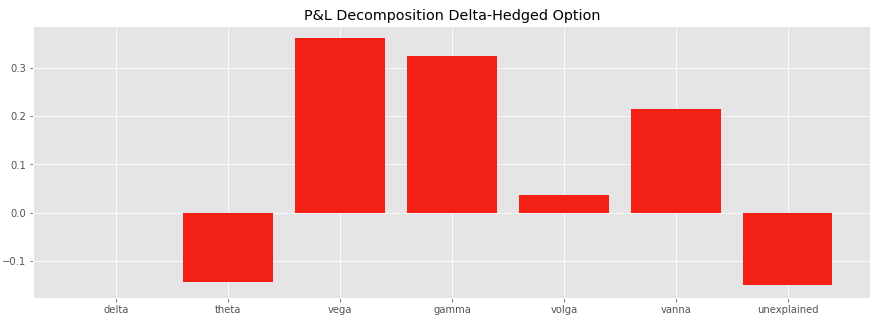

We assume now that the option is closer to expiry, with a one week time to maturity vs three months before.

T0 = 5 / 252 # time to maturityMarket movements between t and t + δt are assumed to be the same as before, the stock is going down, with a realised volatility of 60% while the implied volatility is going up by +10%.

The delta of the option is lower. The option is closer to expiry while we assume that the moneyness of the put option is the same (95%). Now have to sell 0.174 stocks in order to delta-hedge the option.

As highlighted in the chart below, the P&L decomposition is not the same when we are very close to expiry:

Save 25% on All Quant Next Courses with the Coupon Code: QuantNextBlog25

For students and graduates: We offer a 50% discount on all courses, please contact us if you are interested: contact@quant-next.com

We summarize below quantitative finance training courses proposed by Quant Next. Courses are 100% digital, they are composed of many videos, quizzes, applications and tutorials in Python.

Complete training program:

Options, Pricing, and Risk Management Part I: introduction to derivatives, arbitrage free pricing, Black-Scholes model, option Greeks and risk management.

Options, Pricing, and Risk Management Part II: numerical methods for option pricing (Monte Carlo simulations, finite difference methods), replication and risk management of exotic options.

Options, Pricing, and Risk Management Part III: modelling of the volatility surface, parametric models with a focus on the SVI model, and stochastic volatility models with a focus on the Heston and the SABR models.

A la carte:

Monte Carlo Simulations for Option Pricing: introduction to Monte Carlo simulations, applications to price options, methods to accelerate computation speed (quasi-Monte Carlo, variance reduction, code optimisation).

Finite Difference Methods for Option Pricing: numerical solving of the Black-Scholes equation, focus on the three main methods: explicit, implicit and Crank-Nicolson.

Replication and Risk Management of Exotic Options: dynamic and static replication methods of exotic options with several concrete examples.

Volatility Surface Parameterization: the SVI Model: introduction on the modelling of the volatility surface implied by option prices, focus on the parametric methods, and particularly on the Stochastic Volatility Inspired (SVI) model and some of its extensions.

The SABR Model: deep dive on on the SABR (Stochastic Alpha Beta Rho) model, one popular stochastic volatility model developed to model the dynamic of the forward price and to price options.

The Heston Model for Option Pricing: deep dive on the Heston model, one of the most popular stochastic volatility model for the pricing of options.

First we import the libraries that will be used and we create a class EuropeanOptionBS with Black-Scholes prices and Greeks with closed-form formulas.

#import libraries

import matplotlib.pyplot as plt

plt.style.use('ggplot')

import math

import numpy as np

import pandas as pd

from scipy.stats import norm

%matplotlib inline

#Black-Scholes price and Greeks

class EuropeanOptionBS:

def __init__(self, S, K, T, r, q, sigma, Type):

self.S = S

self.K = K

self.T = T

self.r = r

self.q = q

self.sigma = sigma

self.Type = Type

self.d1 = self.d1()

self.d2 = self.d2()

self.price = self.price()

self.delta = self.delta()

self.theta = self.theta()

self.vega = self.vega()

self.gamma = self.gamma()

self.volga = self.volga()

self.vanna = self.vanna()

def d1(self):

d1 = (math.log(self.S / self.K) \

+ (self.r - self.q + .5 * (self.sigma ** 2)) * self.T) \

/ (self.sigma * self.T ** .5)

return d1

def d2(self):

d2 = self.d1 - self.sigma * self.T ** .5

return d2

def price(self):

if self.Type == "Call":

price = self.S * math.exp(-self.q * self.T) * norm.cdf(self.d1) \

- self.K * math.exp(-self.r * self.T) * norm.cdf(self.d2)

if self.Type == "Put":

price = self.K * math.exp(-self.r * self.T) * norm.cdf(-self.d2) \

- self.S * math.exp(-self.q * self.T) * norm.cdf(-self.d1)

return price

def delta(self):

if self.Type == "Call":

delta = math.exp(-self.q * self.T) * norm.cdf(self.d1)

if self.Type == "Put":

delta = -math.exp(-self.q * self.T) * norm.cdf(-self.d1)

return delta

def theta(self):

if self.Type == "Call":

theta1 = -math.exp(-self.q * self.T) * \

(self.S * norm.pdf(self.d1) * self.sigma) / (2 * self.T ** .5)

theta2 = self.q * self.S * math.exp(-self.q * self.T) * norm.cdf(self.d1)

theta3 = -self.r * self.K * math.exp(-self.r * self.T) * norm.cdf(self.d2)

theta = theta1 + theta2 + theta3

if self.Type == "Put":

theta1 = -math.exp(-self.q * self.T) * \

(self.S * norm.pdf(self.d1) * self.sigma) / (2 * self.T ** .5)

theta2 = -self.q * self.S * math.exp(-self.q * self.T) * norm.cdf(-self.d1)

theta3 = self.r * self.K * math.exp(-self.r * self.T) * norm.cdf(-self.d2)

theta = theta1 + theta2 + theta3

return theta

def vega(self):

vega = self.S * math.exp(-self.q * self.T) * self.T** .5 * norm.pdf(self.d1)

return vega

def gamma(self):

gamma = math.exp(-self.q * self.T) * norm.pdf(self.d1) / (self.S * self.sigma * self.T** .5)

return gamma

def volga(self):

volga = self.vega / self.sigma * self.d1 * self.d2

return volga

def vanna(self):

vanna = -self.vega / (self.S * self.sigma * self.T** .5) * self.d2

return vannaThen we enter the parameters, we give one example of set of parameters here.

#parameters

S0 = 100 # stock price

K = 95 # strike price

r = .0 # risk-free interest rate

q = .0 # dividend

T0 = .25 # time to maturity

sigma0 = .4 # implied volatility BS

Type = "Put"

dt = 1 / 252 # 1 business day

# Market changes between t and t + dt

dS = -S0 * .6 * dt**.5 # realised vol = .6

dsigma = .1

T1 = T0 - dt

S1 = S0 + dS

sigma1 = sigma0 + dsigmaWe calculate the P&L between t and t + δt

P0 = EuropeanOptionBS(S0, K, T0, r, q, sigma0, Type).price

P1 = EuropeanOptionBS(S1, K, T1, r, q, sigma1, Type).price

delta0 = EuropeanOptionBS(S0, K, T0, r, q, sigma0, Type).delta

isDeltaHedged = 1 #1 if is delta-hedged, 0 otherwise

dPandL = P1 - P0 - delta0 * dS * isDeltaHedged

print("P&L: " + str(dPandL))We decompose the P&L between the contribution of the different Greeks and we plot it with a barchart.

#initial greeks

theta0 = EuropeanOptionBS(S0, K, T0, r, q, sigma0, Type).theta

vega0 = EuropeanOptionBS(S0, K, T0, r, q, sigma0, Type).vega

gamma0 = EuropeanOptionBS(S0, K, T0, r, q, sigma0, Type).gamma

volga0 = EuropeanOptionBS(S0, K, T0, r, q, sigma0, Type).volga

vanna0 = EuropeanOptionBS(S0, K, T0, r, q, sigma0, Type).vanna

#P&L attribution

delta_PandL = delta0 * dS * (1 - isDeltaHedged)

theta_PandL = theta0 * dt

vega_PandL = vega0 * dsigma

gamma_PandL = 1 / 2 * gamma0 * dS**2

volga_PandL = 1 / 2 * volga0 * dsigma**2

vanna_PandL = vanna0 * dS * dsigma

unexplained = dPandL - sum([delta_PandL, theta_PandL, vega_PandL, gamma_PandL, volga_PandL, vanna_PandL])

y = [delta_PandL, theta_PandL, vega_PandL, gamma_PandL, volga_PandL, vanna_PandL, unexplained]

x = ["delta", "theta", "vega", "gamma", "volga", "vanna","unexplained"]

fig = plt.figure(figsize=(15, 5))

plt.bar(x, y)

plt.title("P&L Decomposition")

plt.show();

In this post we give an introduction to the Heston model which is one of the most used stochastic volatility model. It assumes that the

In the previous post (link) dedicated to the pricing of defaultable bonds with a reduced form model, we saw how to price a zero coupon

The Merton Jump Diffusion (MJD) model was introduced in a previous article (link). It is an extension of the Black-Scholes model adding a jump part