In this post we give an introduction to the Heston model which is one of the most used stochastic volatility model. It assumes that the

Stochastic Calculus is a branch of mathematics that deals with random processes. Beyond probabilities it also has links with differential equations, and is widely used in finance particularly for option modelling.

Kiyosi Itô (1915-2008) pioneered the field inventing the concept of stochastic integral and stochastic differential equations.

In order to define a stochastic integral, we first define it for elementary stochastic processes, which can be expressed as a sum of stochastic variables (Ai)i=1..n times the indicator functions on time intervals [ti-1,ti): 1[ti-1,ti)(t)=1 if t∈[ti-1,ti).

A stochastic process is elementary if it can be approximated by a step function:

For such process the stochastic integral between 0 and T is defines as following, with the Brownian motion Wt:

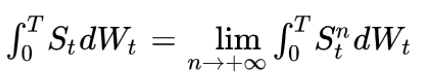

For a general process St the stochastic integral is defined as the limit of the integral for an elementary process converging to St:

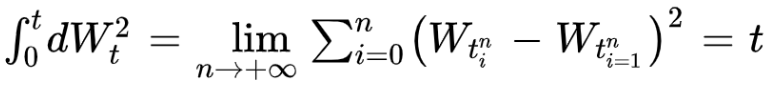

If we calculate the stochastic integrale between 0 and t of the square of dWt we find the quadratic variation of the brownian motion. It is equal to t:

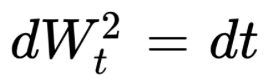

So by taking the differential we can write the following expression, very useful in stochastic differential equations and stochastic integrals:

The Ito Isometry allows to calculate the variance and the covariance of random variables which are defined by an Ito integral.

The expectation of the product of two integrals over a Brownian motion Wt is equal to the expectation of the integral of the product by replacing the square of dWt by dt.

We have as well:

An Itô process Xt has the following form:

Or by taking the differential:

µt and σt are random processes, Wt is a Brownian motion.

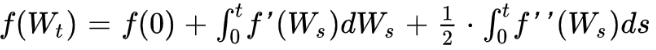

Itô Lemma is one of the main result in stochastic calculus.

The derivative of a function f twice differentiable in x and differentiable in t is equal to:

Xt being an Itô process.

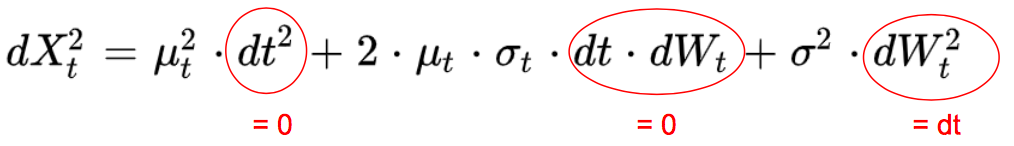

In order to demonstrate it, we do a Taylor development of f at the second order, dX2 being equal to σ2.dt:

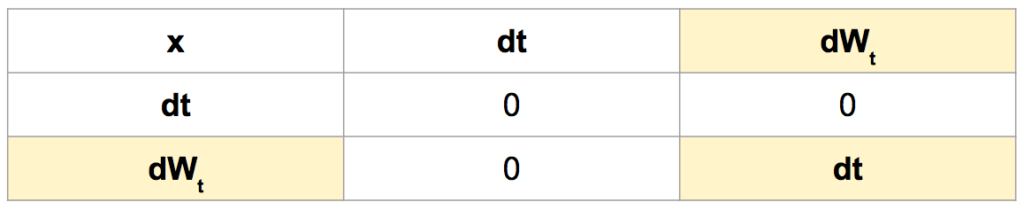

The following multiplication table is a good summary of Ito’s lemma and useful when resolving stochastic differential equations or stochastic integrals.

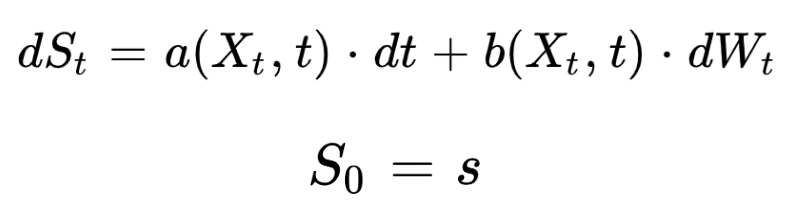

A stochastic differential equation (SDE) has the following form:

This is a generalisation of standard differential equations, where one or more terms is a stochastic process.

We only consider continuous processes, we do not consider processes with jumps here.

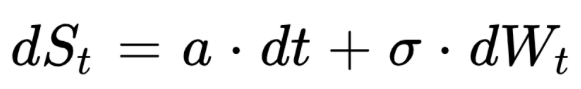

Example 1: a, σ constant

A first simple example of SDE is with a and σ constant:

By integrating between 0 and T we get the following expression for ST.

ST follows a gaussian distribution with a mean equal to S0 + a.T and a variance equal to σ2.T

Example 2: Geometric Brownian Motion

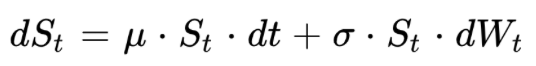

Another important example in finance is the geometric brownian motion, often used to model the dynamic of stock prices.

This is typically the case in the famous Black-Scholes model.

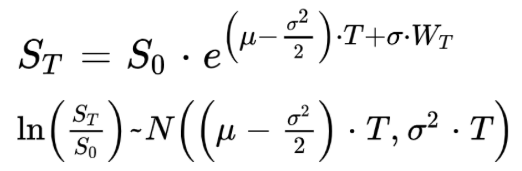

The solution of this SDE has the following expression, ST follows a log-normal distribution:

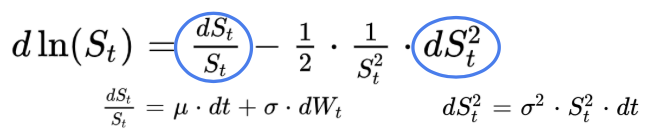

To demonstrate it, we apply the Ito’s lemma to the fonction logarithm ln.

The first derivatives is dln(x) / dx = 1 / x while the second derivatives is d2ln(x) / dx2 = – 1 / x2:

After regrouping the terms in dt and the terms in dWt we get the following expression for the differential of ln(St), and we integrate it between 0 and T to finish the demonstration.

Save 25% on All Quant Next Courses with the Coupon Code: QuantNextBlog25

For students and graduates: We offer a 50% discount on all courses, please contact us if you are interested: contact@quant-next.com

We summarize below quantitative finance training courses proposed by Quant Next. Courses are 100% digital, they are composed of many videos, quizzes, applications and tutorials in Python.

Complete training program:

Options, Pricing, and Risk Management Part I: introduction to derivatives, arbitrage free pricing, Black-Scholes model, option Greeks and risk management.

Options, Pricing, and Risk Management Part II: numerical methods for option pricing (Monte Carlo simulations, finite difference methods), replication and risk management of exotic options.

Options, Pricing, and Risk Management Part III: modelling of the volatility surface, parametric models with a focus on the SVI model, and stochastic volatility models with a focus on the Heston and the SABR models.

A la carte:

Monte Carlo Simulations for Option Pricing: introduction to Monte Carlo simulations, applications to price options, methods to accelerate computation speed (quasi-Monte Carlo, variance reduction, code optimisation).

Finite Difference Methods for Option Pricing: numerical solving of the Black-Scholes equation, focus on the three main methods: explicit, implicit and Crank-Nicolson.

Replication and Risk Management of Exotic Options: dynamic and static replication methods of exotic options with several concrete examples.

Volatility Surface Parameterization: the SVI Model: introduction on the modelling of the volatility surface implied by option prices, focus on the parametric methods, and particularly on the Stochastic Volatility Inspired (SVI) model and some of its extensions.

The SABR Model: deep dive on on the SABR (Stochastic Alpha Beta Rho) model, one popular stochastic volatility model developed to model the dynamic of the forward price and to price options.

The Heston Model for Option Pricing: deep dive on the Heston model, one of the most popular stochastic volatility model for the pricing of options.

In this post we give an introduction to the Heston model which is one of the most used stochastic volatility model. It assumes that the

In the previous post (link) dedicated to the pricing of defaultable bonds with a reduced form model, we saw how to price a zero coupon

The Merton Jump Diffusion (MJD) model was introduced in a previous article (link). It is an extension of the Black-Scholes model adding a jump part