In this post we give an introduction to the Heston model which is one of the most used stochastic volatility model. It assumes that the

In this article, we will present the Newton-Raphson method for calculating the implied volatility from option prices.

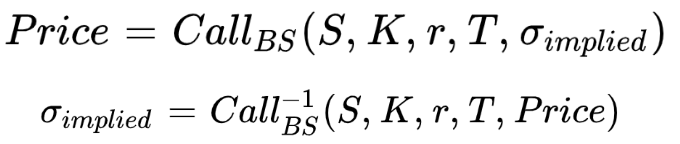

In Black-Scholes model, the price of an option is a function of five variables:

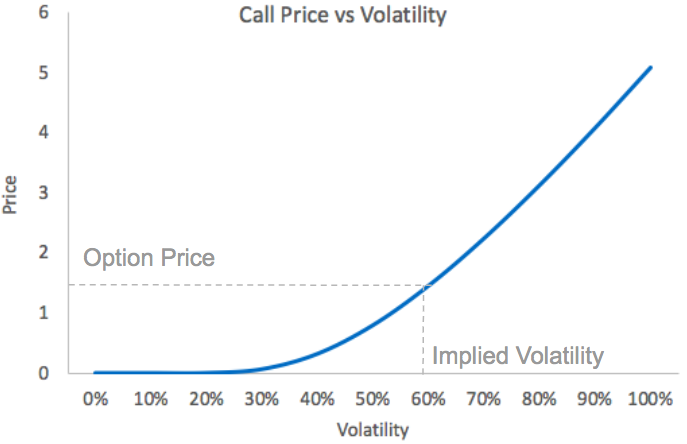

The chart below shows the price of a European call option when changing the volatility, all other parameters being fixed. The option price is strictly increasing with volatility.

Call Price vs volatility with S = 100, K = 120, T = 1/12, r = 2%

The volatility is not directly observable, but if we know the price of the option we can determine the implied volatility.

There is no formula, no closed form solution for the implied volatility of an option, so we need to apply a numerical method to estimate the implied volatility from option prices.

The objective is to find the volatility level so that the Black-Scholes price is equal to the observed option price.

So we want to find the root of the function Black-Scholes price minus observed price.

The Algorithm

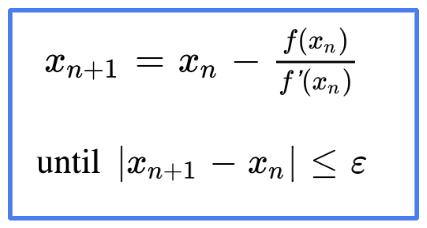

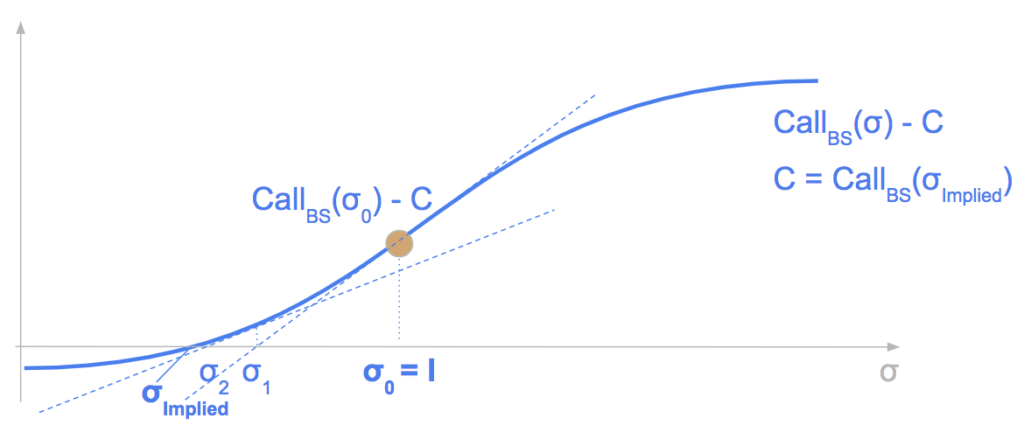

The Newton Raphson method is a simple algorithm to find the root of a function:

x0 is our initial guess.

Then we approximate the function by its tangent line, and our new estimate is the x-intercept of this tangent line.

We do the same with this second guess, the third guess, and so on.

We fix a tolerance level and we iterate the algorithm until the difference between two consecutive estimations is below this level.

Newton-Raphson Algorithm

Derivation

The method is derived from a simple second order Taylor expansion of the function f around xn, εn is between x and xn.

With

and

we get the relationship between the root of the function and xn:

When neglecting the last term, we find our new estimation of the root from our previous guess.

The convergence is quadratic, so it is quite fast.

Python Code for a Generic Newton-Raphson Algorithm

Here is a Python code with a generic Newton-Raphson algorithm.

The function has two arguments, the function f and the initial guess x0.

We approximate the derivative with finite difference.

#Import libraries

import math

import numpy as np

from scipy.stats import norm

def newton_step(f, x0):

def df(x):

dx = 0.00001

return (f(x + dx) - f(x)) / dx

return x0 - f(x0)/df(x0)

def newton(f,x0,tol):

while (abs(newton_step(f, x0) - x0) > tol):

x0 = newton_step(f, x0)

return x0We will use the Newton-Raphson algorithm to find the implied volatility of a European call option. The price of the European call price is determined by the Black-Scholes formula.

def CallPrice(S, sigma, K, T, r):

d1 = (math.log(S / K) + (r + .5 * sigma**2) * T) / (sigma * T**.5)

d2 = d1 - sigma * T**0.5

n1 = norm.cdf(d1)

n2 = norm.cdf(d2)

DF = math.exp(-r * T)

price=S * n1 - K * DF * n2

return priceWe want to find the root of the function Black-Scholes call price minus the target price, the only argument being the implied volatility, other parameters being fixed.

#CallPrice(vol) - TargetPrice

CallPriceVol = lambda vol: CallPrice(S, vol, K, T, r) - CWe assume that the asset price is equal to 100, the strike price is equal to 105, the maturity of the option is in six months, the risk-free interest rate is equal to 2%.

The true value of the implied volatility is 20%.

#parameters

S = 100 #asset price

K = 105 #strike price

T = .5 #time to maturity

r = .02 #risk-free interest rate

vol = .2 #implied volatility

C = CallPrice(S, vol, K, T, r) #target priceWe estimate the implied volatility with the Newton-Raphson algorithm, the tolerance is fixed at 10-8. The initial guess is arbitrarily fixed at 10%.

init = .1

tol = 10**-8

print(newton(CallPriceVol, init, tol))In our example, the convergence is very fast, only three iterations are needed to reach the convergence with a tolerance level qt 10-8.

x0 = init

for i in range(0, 4):

print(x0)

x0 = newton_step(CallPriceVol, x0)Drawbacks

There are however several drawbacks with this method:

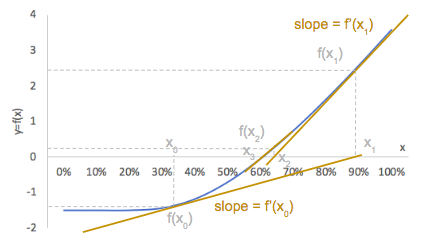

When a function is concave or convex, there is no problem of convergence of the algorithm but this is not the case with the Black-Scholes option price.

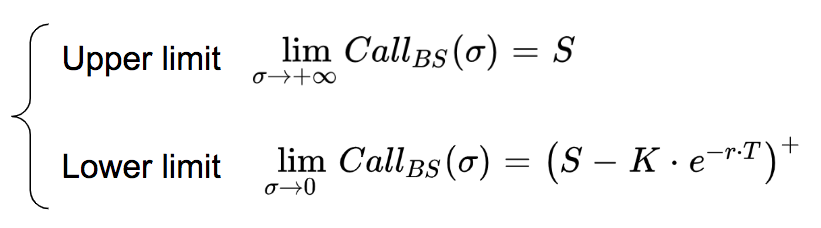

The Black-Scholes option price is an increasing function of volatility, with an upper and a lower limit.

Here is an illustration of the price of the option as a function of volatility.

We see that there is an inflection point.

It can be shown that the function is convex on the left of the inflexion point [0,I] and concave on the right [I,+∞[ with I the inflexion point having the following expression.

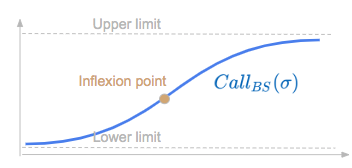

Using the inflexion point as initial guess, we can find the volatility implied by option price with the Newton-Raphson algorithm, the series of consecutive estimations (σn) is monotonous.

We use the vega of the call option to calculate the derivative of its price with respect to the volatility.

Source: Peter Tankov. Calibration de modèles et couverture de produits dérivés. DEA. Calibration de modèles et couverture de produits dérivés, Master “Modélisation Aléatoire”, Université Paris-Diderot (Paris 7), 2006, pp.143. ⟨cel-00664993⟩

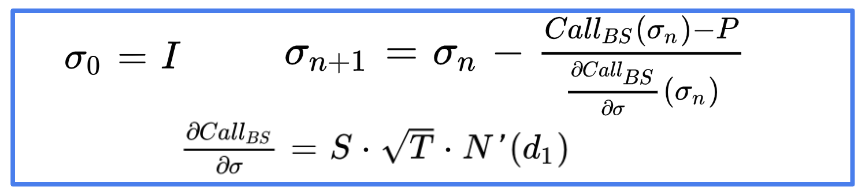

Below is an illustration of this.

We start with the inflexion point as initial guess. Our next guess is the x-intercept of the tangent. And we continue.

σ -> CallBS(σ) – CallBS(σImplied) is convex on the left of the inflexion point.

The series is monotonous, we have σ0 > σ1 > … > σImplied.

Python Code

Below is the Python code of this algorithm.

Using above parameters for S, K, T and r we find that the inflexion point is equal to 39.39%.

def InflexionPoint(S, K, T, r):

m = S / (K * math.exp(-r * T))

return math.sqrt(2 * np.abs(math.log(m)) / T)

I = InflexionPoint(S, K, T, r)

print("Inflexion Point:",I)The Newton Raphson algorithm to calculate the implied volatility is no more generic.

The derivative of the function is the Greek vega, which measures the option’s sensitivity to implied volatility and is obtained with a closed form expression.

def vega(S, sigma, K, T, r):

d1 = (math.log(S / K) + (r + .5 * sigma**2) * T) / (sigma * T**.5)

vega = S * T**0.5 * norm.pdf(d1)

return vega

def ImpliedVolCall(C, S, K, r, T,tol):

x0 = InflexionPoint(S, K, T, r)

p = CallPrice(S, x0, K, T, r)

v = vega(S, x0, K, T, r)

while (abs((p - C) / v) > tol):

x0 = x0 - (p - C) / v

p = CallPrice(S, x0, K, T, r)

v = vega(S, x0, K, T, r)

return x0

tol= 10**-8

ImpliedVolCall(C, S, K, r, T,tol)Save 25% on All Quant Next Courses with the Coupon Code: QuantNextBlog25

For students and graduates: We offer a 50% discount on all courses, please contact us if you are interested: contact@quant-next.com

We summarize below quantitative finance training courses proposed by Quant Next. Courses are 100% digital, they are composed of many videos, quizzes, applications and tutorials in Python.

Complete training program:

Options, Pricing, and Risk Management Part I: introduction to derivatives, arbitrage free pricing, Black-Scholes model, option Greeks and risk management.

Options, Pricing, and Risk Management Part II: numerical methods for option pricing (Monte Carlo simulations, finite difference methods), replication and risk management of exotic options.

Options, Pricing, and Risk Management Part III: modelling of the volatility surface, parametric models with a focus on the SVI model, and stochastic volatility models with a focus on the Heston and the SABR models.

A la carte:

Monte Carlo Simulations for Option Pricing: introduction to Monte Carlo simulations, applications to price options, methods to accelerate computation speed (quasi-Monte Carlo, variance reduction, code optimisation).

Finite Difference Methods for Option Pricing: numerical solving of the Black-Scholes equation, focus on the three main methods: explicit, implicit and Crank-Nicolson.

Replication and Risk Management of Exotic Options: dynamic and static replication methods of exotic options with several concrete examples.

Volatility Surface Parameterization: the SVI Model: introduction on the modelling of the volatility surface implied by option prices, focus on the parametric methods, and particularly on the Stochastic Volatility Inspired (SVI) model and some of its extensions.

The SABR Model: deep dive on on the SABR (Stochastic Alpha Beta Rho) model, one popular stochastic volatility model developed to model the dynamic of the forward price and to price options.

The Heston Model for Option Pricing: deep dive on the Heston model, one of the most popular stochastic volatility model for the pricing of options.

In this post we give an introduction to the Heston model which is one of the most used stochastic volatility model. It assumes that the

In the previous post (link) dedicated to the pricing of defaultable bonds with a reduced form model, we saw how to price a zero coupon

The Merton Jump Diffusion (MJD) model was introduced in a previous article (link). It is an extension of the Black-Scholes model adding a jump part