In this post we give an introduction to the Heston model which is one of the most used stochastic volatility model. It assumes that the

The spectral decomposition of a period function via Fourier series can be generalised to any integrale function via the Fourier transform.

And we can recover the initial function from its frequency domain representation by applying the Fourier inversion theorem.

The characteristic function of a stochastic variable is the Fourier transform of its density function.

While it is often difficult to find the distribution function for a few stochastic processes, it is more simple to get their characteristic function, as it can be derived as the solution of a partial differential equation using the Feynman Kac theorem (see for example Cornelis W Oosterlee, Lech A Grzelak (2020): “Mathematical Modeling And Computation In Finance” ).

And if we know the characteristic function we can recover the density function by applying the Fourier inversion theorem.

And we can easily derive the price of a call option using the characteristic function instead of the density function of the log of the asset price with a semi-analytic solution (see for example Ricardo Crisóstomo (2014), “An Analysis of the Heston Stochastic Volatility Model: Implementation and Calibration using Matlab”).

The price of the call option has a similar expression as in the Black-Scholes formula, instead of using the density function, the probabilities are calculated with an integral via the characteristic function.

This is typically the case for the Heston model (see Heston, Steven L. (1993), “A closed-form solution for options with stochastic volatility with applications to bond and currency options”).

In the Heston model, under the risk neutral probability, the dynamic of the asset price and its variance can be expressed as:

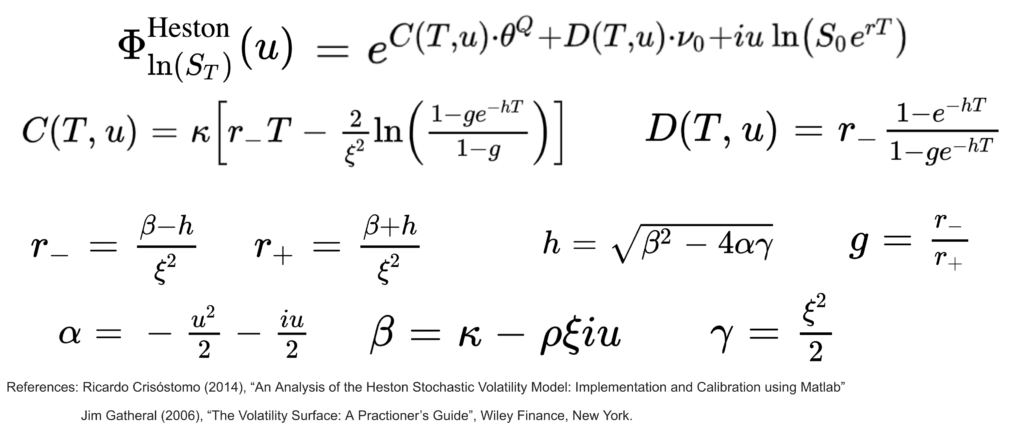

Here is the expression of the characteristic function of the log price under the Heston model:

The computation of the Discrete Fourier Transform (DFT) can be time consuming with O(N2) complexity. The Fast Fourier Transform (FFT) are efficient algorithms for reducing the complexity from O(N2) to (O(N.log(N)). They work by dividing the DFT problem into smaller sub-problems (divide-and-conquer) and recursively computing them, with a significant reduction in the number of arithmetic operations (reference: https://en.wikipedia.org/wiki/Fast_Fourier_transform).

Save 25% on All Quant Next Courses with the Coupon Code: QuantNextBlog25

For students and graduates: We offer a 50% discount on all courses, please contact us if you are interested: contact@quant-next.com

We summarize below quantitative finance training courses proposed by Quant Next. Courses are 100% digital, they are composed of many videos, quizzes, applications and tutorials in Python.

Complete training program:

Options, Pricing, and Risk Management Part I: introduction to derivatives, arbitrage free pricing, Black-Scholes model, option Greeks and risk management.

Options, Pricing, and Risk Management Part II: numerical methods for option pricing (Monte Carlo simulations, finite difference methods), replication and risk management of exotic options.

Options, Pricing, and Risk Management Part III: modelling of the volatility surface, parametric models with a focus on the SVI model, and stochastic volatility models with a focus on the Heston and the SABR models.

A la carte:

Monte Carlo Simulations for Option Pricing: introduction to Monte Carlo simulations, applications to price options, methods to accelerate computation speed (quasi-Monte Carlo, variance reduction, code optimisation).

Finite Difference Methods for Option Pricing: numerical solving of the Black-Scholes equation, focus on the three main methods: explicit, implicit and Crank-Nicolson.

Replication and Risk Management of Exotic Options: dynamic and static replication methods of exotic options with several concrete examples.

Volatility Surface Parameterization: the SVI Model: introduction on the modelling of the volatility surface implied by option prices, focus on the parametric methods, and particularly on the Stochastic Volatility Inspired (SVI) model and some of its extensions.

The SABR Model: deep dive on on the SABR (Stochastic Alpha Beta Rho) model, one popular stochastic volatility model developed to model the dynamic of the forward price and to price options.

The Heston Model for Option Pricing: deep dive on the Heston model, one of the most popular stochastic volatility model for the pricing of options.

In this post we give an introduction to the Heston model which is one of the most used stochastic volatility model. It assumes that the

In the previous post (link) dedicated to the pricing of defaultable bonds with a reduced form model, we saw how to price a zero coupon

The Merton Jump Diffusion (MJD) model was introduced in a previous article (link). It is an extension of the Black-Scholes model adding a jump part